- Clarify your mission and niche.

- Understand legal and financial basics.

- Map out launch, growth, and compliance.

You’re not just starting a “project.” You’re building a structure that can outlast you and keep helping long after day one.

Understanding Nonprofits

Definition and Purpose

A nonprofit is an organization created to serve a social or public benefit—without the goal of making a profit. That means any revenue is funneled right back into its mission, whether that’s rescuing animals, educating youth, or protecting the environment.

Why Consider Starting a Nonprofit?

- Social impact: You’re changing lives. That’s the whole point.

- Tax-exempt status: With proper nonprofit bookkeeping, you can apply for federal tax exemption.

- Personal fulfillment: It feels amazing to do meaningful work and rally others behind a cause.

| Aspect | What it means |

|---|---|

| Purpose | Serve a public or social good, not owners or shareholders. |

| Profits | Reinvested into the mission instead of distributed. |

| Funding | Grants, donations, events, and earned income. |

Preliminary Research and Planning

Identifying a Mission

What’s the issue you’re passionate about? Is it overfilled shelters, stray cats, or farm animal advocacy? Be specific and action-focused. Your mission is your anchor.

Conducting Market Research

Who needs your services? Who else is doing similar work? A quick scan of the nonprofit landscape will help you find your niche and avoid unnecessary overlap.

Feasibility Study

Let’s talk resources. How much do you need to start? Where will it come from? Consider Fractional CFO services to model realistic startup budgets and projections. Bonus points for scoping out startup grants or animal rescue-specific funding sources.

- Write a one-sentence mission statement.

- Identify at least 3 similar nonprofits and your unique angle.

- List your first-year must-have expenses and likely revenue sources.

Legal Requirements and Incorporation

Choosing a Name

It needs to be unique, memorable, and mission-aligned. Check your state’s business name database, and don’t forget to Google it!

Creating a Board of Directors

Choose folks who bring a mix of passion and skills—finance, law, fundraising, and maybe even someone who’s cleaned a few litter boxes. 🐾

Filing Articles of Incorporation

This step legally forms your nonprofit in your state. Each state’s requirements vary, so visit your Secretary of State’s website for details.

Drafting Bylaws

These are your internal rules: board meetings, voting rights, conflict resolution—basically, your organization’s constitution.

Getting an EIN and Filing for 501(c)(3)

Head to the IRS website for a free EIN application. Then apply for 501(c)(3) tax-exempt status. Consider hiring pros to handle your Form 990 filing and avoid pitfalls.

| Step | Action |

|---|---|

| 1 | Choose a unique, mission-aligned name. |

| 2 | Recruit an initial board of directors. |

| 3 | File Articles of Incorporation with your state. |

| 4 | Draft bylaws and governance policies. |

| 5 | Get an EIN and apply for 501(c)(3) status. |

Building a Foundation

Developing a Business Plan

Outline your vision, programs, staffing, funding strategies, and marketing plan. If it sounds overwhelming, don’t worry—there are great nonprofit templates out there, or you can ask for help.

Fundraising and Grant Writing

Start building your donor base and writing grants. A well-crafted proposal is your ticket to startup capital. Be clear, compelling, and mission-driven.

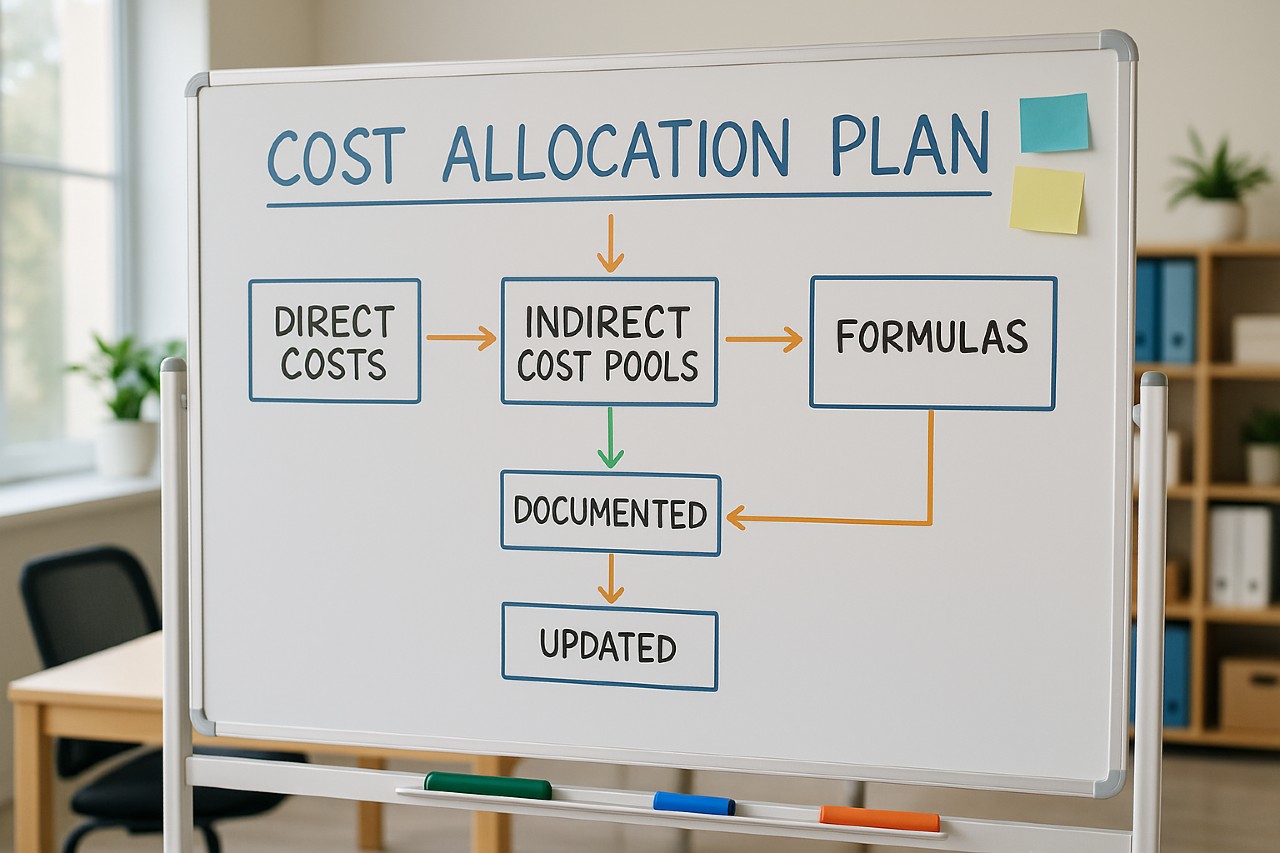

Budgeting and Financial Controls

Every dollar matters. Consider a financial statement review and set up strong internal controls to track donations, expenses, and compliance.

Treat your nonprofit like a business with a heart—clear plans, real budgets, and systems that support your mission instead of stressing you out.

Launching and Growing Your Nonprofit

Launching with a Bang

Host a launch event (virtual or in-person). Share your story, your mission, and your goals. Invite volunteers, supporters, and the press. Don’t forget the dog treats and catnip.

Building a Community

From newsletters to Instagram reels, stay connected with your audience. Use authentic storytelling to build trust and momentum.

Measuring Success

Set clear KPIs—animals rescued, funds raised, volunteer hours logged. Review regularly and adjust course as needed. And yes, celebrate the wins!

- Plan a simple event or live stream.

- Announce on email + social.

- Share behind-the-scenes content.

- Highlight volunteers and success stories.

- Track 3–5 key metrics.

- Report back to your supporters.

Sustaining and Scaling

Strategic Growth

Create a 3–5 year roadmap. Revisit your goals annually. Consider outsourced financial leadership to plan sustainable growth.

Diversifying Revenue

Don’t rely on one grant or one major donor. Explore monthly donor programs, merchandise, partnerships, and events.

Staying Compliant

Keep up with annual audits, 990 filings, and federal/state reports. Transparency builds donor trust and keeps you in the good graces of the IRS.

Sustainable nonprofits pace their growth, protect their reserves, and build systems that can handle the next level before they get there.

Frequently Asked Questions

Do I need a lawyer to start a nonprofit?

No, but it’s a good idea to have one review your incorporation documents and 501(c)(3) application to avoid mistakes that could cost you time or money.

Can I pay myself a salary?

Yes! You can (and should) compensate yourself fairly if you’re working for the organization—just keep it in line with industry standards and your budget.

How long does it take to get 501(c)(3) status?

It typically takes 3–6 months, depending on the IRS backlog. Some applications are faster if you file Form 1023-EZ.

Is starting a nonprofit expensive?

Startup costs can range from $1,000 to $3,000+ depending on legal help, state fees, and other costs. But many founders start small and scale over time!

Final Thoughts: Start Smart, Start Strong

Starting a nonprofit is an incredible way to make lasting change in the world—especially in the animal welfare space. While it takes planning, paperwork, and persistence, you’re building something that matters. Take your time, lean on experts when you need to, and remember—you don’t need to do it all alone.

And hey, if you ever feel overwhelmed by the finances (like when you stare at a Form 990 too long), we’ve got you:

- Write a one-page summary of your mission, who you help, and how.

- List 3–5 people who could be founding board members.

- Pick a realistic launch month in the next 6–12 months.

Now go forth and build something amazing. You’ve got the passion, now you’ve got the plan. 💪🐾