Not all audits are created equal—and not every nonprofit needs the most expensive one. If you’re navigating the

maze of nonprofit financial reporting, understanding the different types of audits for nonprofits

can save your organization time, money, and stress. In this guide, we’ll walk you through compilations, reviews,

and full audits—what they are, when to use them, and how to know which one is right for your nonprofit.

- What compilations, reviews, and audits actually are.

- When each level of service makes sense.

- How funder requirements drive your choice.

- Practical FAQs to keep you out of trouble.

You don’t “win” by buying the fanciest audit. You win by choosing the right level of assurance for

your mission and funders.

Why Nonprofit Financial Reporting Matters

Financial transparency builds trust—with donors, grantors, regulators, and your own board. Whether you need a

financial statement review

or a full audit depends on your funding sources and reporting obligations. Done right, financial reporting supports

good decision-making and long-term sustainability.

Clear, accurate numbers turn skepticism into confidence—for your board, your banker, and that major donor who reads every line.

Types of Audits for Nonprofits

There are three primary types of financial reviews used by nonprofits: compilations, reviews, and audits. Let’s explore the differences.

| Type | Cost | Assurance | Typical Use |

|---|---|---|---|

| Compilation | Low | None | Internal reporting, simple requests |

| Review | Moderate | Limited | Funders wanting basic verification |

| Audit | High | High | Federal grants, major donors, compliance |

Compilations: A Quick Financial Snapshot

A compilation is the most basic form of financial reporting. A CPA takes your financial data and presents it

in financial statements—no testing, no assurance, just formatting. It’s ideal for internal reporting or

low-risk funding needs.

- Cost: Low

- Assurance level: None

- Best for: Internal use or simple funder requests

Reviews: A Level Above Compilation

In a review, a CPA performs limited procedures—such as ratio analysis and inquiries—to assess whether the

financials “make sense.” It provides limited assurance and is often enough for mid-size grants or smaller lenders.

- Cost: Moderate

- Assurance level: Limited

- Best for: Donors or funders who want basic verification

Audits: The Highest Level of Scrutiny

A full audit dives deep into financial records and internal controls. The CPA issues an opinion on whether your

financials are fairly presented in accordance with GAAP. Audits are typically required when your nonprofit

receives over $750,000 in federal funding (triggering a

Single Audit).

- Cost: High

- Assurance level: High

- Best for: Federal grants, major donors, or regulatory compliance

Need help preparing? Check out our

Nonprofit Audit Support

page for a detailed checklist.

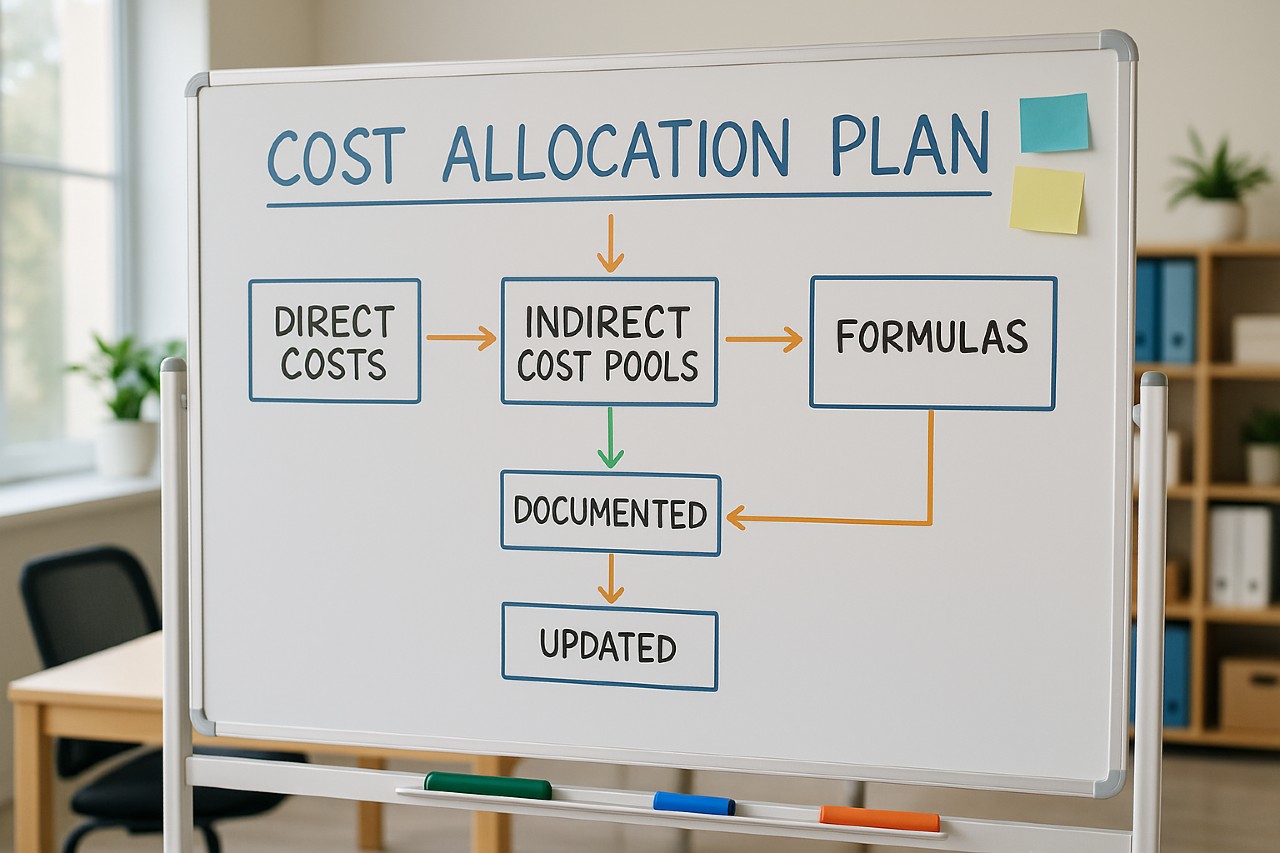

The Audit Process (and Why It’s Expensive)

Unlike a review or compilation, an audit involves in-depth procedures and multiple phases:

1. Planning

Auditors assess your nonprofit’s risks and internal control structure, define the scope, and request initial documents.

2. Fieldwork

This is the most time-consuming phase. Auditors test transactions, review compliance, and validate key financial data.

3. Reporting

Auditors issue a report that includes their opinion and recommendations for improvement—crucial for funders and regulators.

While audits can take several weeks and cost more than simpler reviews, they offer unmatched credibility.

Organizations with complex financials or public funding may have no alternative.

Behind every audit is planning, testing, documentation, partner review, and time spent answering funder and board

questions. You’re paying for assurance, not just a PDF.

Common Audit Misconceptions

Let’s clear up a few myths:

- “Every nonprofit must get an audit.” Nope—many can get by with a review or compilation, depending on their funders and revenue.

- “An audit guarantees no fraud.” Also no. Audits assess fairness of financial reporting but don’t catch every issue.

- “Audits are only about money.” Audits also assess your systems, processes, and internal controls—which is invaluable for growth.

Reality: The right level of assurance is about risk, regulation, and relationships with

funders—not about checking a generic “audit” box.

How to Choose the Right Financial Review

Ask yourself the following:

- Do your funders require an audit?

- Do you receive federal or state funding?

- What’s your annual revenue?

- Do you need assurance for major donors?

Unsure? Our

Fractional CFO services

can help you evaluate the best approach based on your goals and budget.

- Mostly small private donations, no big grants? Compilation or review may be enough.

- Bank loans, sizable grants, or larger donors? Lean toward a review.

- Federal funding, state contracts, or complex operations? You’re likely in audit territory.

Frequently Asked Questions

Does every nonprofit need an audit?

No. Audits are typically only required if you meet specific grant, funding, or regulatory thresholds. Many small organizations use compilations or reviews instead.

What is a Single Audit?

It’s a specialized audit required for nonprofits that spend $750,000+ in federal funds annually. It includes both financial and compliance components.

How often should a nonprofit get audited?

If you’re required by funders or law, it’s usually annual. Otherwise, you may do a review annually and a full audit every 2–3 years.

What’s the difference between a review and an audit?

A review gives limited assurance through analysis and inquiries; an audit includes verification and testing, offering full assurance.

How can I reduce audit costs?

Stay organized year-round, use reliable accounting software, and get a

pre-audit financial review

to catch issues early.

Final Thoughts: Choose the Right Audit for Your Nonprofit

Understanding the types of audits for nonprofits helps you stay compliant, save money, and meet your funders’

expectations. Whether it’s a simple compilation or a full audit, choosing the right level of review keeps your

mission on track and your books in order.

Need help deciding? Let’s talk! We offer:

- Financial Statement Review Services

- Nonprofit Bookkeeping

- 990 Tax Filing

- Audit Support for Nonprofits

Make a simple table of your current and expected funders, their requirements (compilation, review, or audit), and

deadlines. Then align your level of assurance with what truly matters—for compliance and for trust.

Let’s make sure your financials work as hard as you do. 🧾🐾