Navigating nonprofit tax compliance might not be the most exciting part of running an animal shelter or sanctuary—but trust me, it’s one of the most important. Staying IRS-compliant ensures your nonprofit keeps that all-important tax-exempt status and builds trust with donors and regulators alike. In this guide, we’re breaking down what you need to know—federal filings, state rules, UBIT pitfalls, and more. Let’s make sure your organization stays focused on its mission (and off the IRS’s radar).

- Understand how to get and keep 501(c)(3) status.

- Know which Form 990 your nonprofit should file.

- Avoid common UBIT and state-compliance pitfalls.

The more buttoned-up your tax compliance is, the more confidently donors (and the IRS) can trust your mission.

Tax-Exempt Status: What You Need to Know

Nonprofit tax compliance starts with getting tax-exempt status from the IRS. Most nonprofits fall under Section 501(c)(3) of the Internal Revenue Code. But this status isn’t automatic—you have to apply for it and maintain it.

How to Qualify

- Incorporate as a nonprofit in your state.

- Get an EIN from the IRS.

- Apply for 501(c)(3) status using Form 1023 or Form 1023-EZ.

Maintaining Your Status

- Operate according to your exempt purpose.

- Avoid political campaign activity.

- Prevent private benefit to individuals or board members.

- File Form 990 annually.

Not confident in your annual filing process? Our Form 990 tax filing service can help you avoid costly mistakes.

Tax-exempt status is a privilege, not a “set it and forget it” label. Your operations have to keep earning it year after year.

Federal Filing Requirements

The IRS requires most tax-exempt nonprofits to file an annual return. Which version of Form 990 you file depends on your organization’s size.

Form 990 Options

- Form 990-N: Gross receipts under $50,000

- Form 990-EZ: Gross receipts under $200,000 and assets under $500,000

- Form 990: Organizations over those thresholds

- Form 990-PF: Private foundations only

Deadline: The 15th day of the 5th month after your fiscal year ends (typically May 15).

Miss three years in a row and the IRS will automatically revoke your tax-exempt status—yikes. If you need more time, file Form 8868 for an extension.

| Form type | When it applies |

|---|---|

| 990-N | Gross receipts < $50,000 |

| 990-EZ | Gross receipts < $200,000 and assets < $500,000 |

| 990 | Above 990-EZ thresholds |

| 990-PF | Private foundations only |

State Tax Compliance

Nonprofit tax compliance doesn’t stop with the IRS. Your state likely has its own set of rules.

Common State Requirements

- Charitable solicitation registration—usually with the Secretary of State or Attorney General.

- Sales tax exemption—you often need to apply separately for this.

- Annual renewals—some states require you to file your Form 990 with them, too.

Even if you’re federally exempt, you might still owe state corporate taxes if you’re earning unrelated income. Want help navigating your nonprofit’s financial reports? Check out our Financial Statement Review service.

If you raise funds in multiple states (hello, online donations), you may have multistate registration requirements, too.

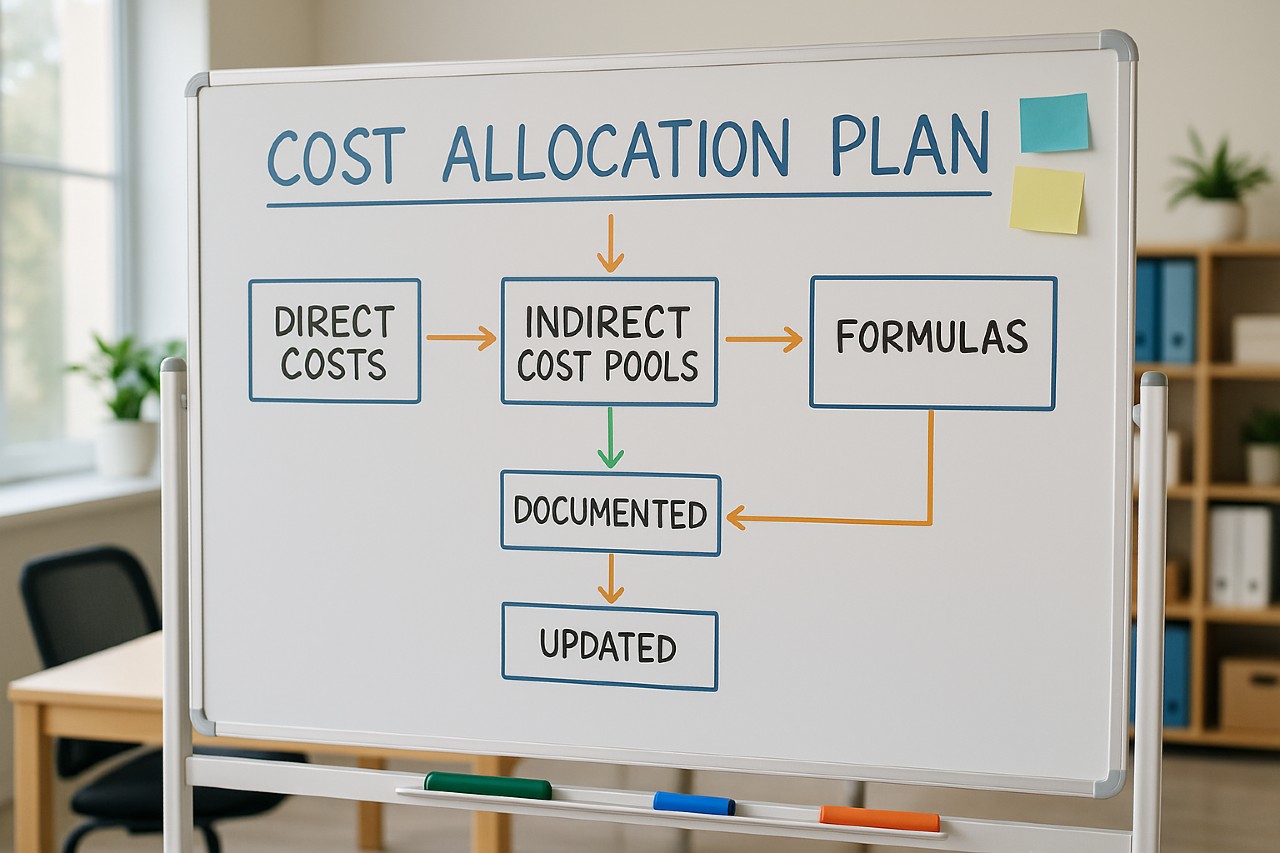

Unrelated Business Income Tax (UBIT)

Running a little side hustle through your nonprofit? Be careful. If you’re earning income from activities not related to your mission, you might owe taxes on it.

What Triggers UBIT?

- The activity is a trade or business.

- It’s carried on regularly.

- It’s not substantially related to your exempt purpose.

Examples of UBIT Activities

- Selling ads on your nonprofit’s website

- Renting out space for private events

- Operating a gift shop with non-mission items

If UBIT applies, you’ll need to file Form 990-T. You may also want to consult with a fractional CFO to see whether a taxable subsidiary makes sense for your nonprofit.

If you’d still be doing the activity even without your mission, it might be UBIT territory—time to ask questions.

Record-Keeping Requirements

Good record-keeping isn’t just helpful—it’s legally required. If the IRS comes calling (or even your donors), you’ll want your documentation buttoned up.

What to Keep

- Articles of incorporation and bylaws

- Determination letter from the IRS

- Form 990 copies for at least 3–7 years

- Receipts, bank statements, and donation records

- Board meeting minutes

Want to automate and organize your nonprofit’s books? Our nonprofit bookkeeping services can make that easy.

Keep digital copies of key documents in a shared, backed-up drive with clear folder names. Future-you will be very grateful.

Staying Updated and Informed

Tax law changes. A lot. So how do you stay current?

- Bookmark the IRS Exempt Organizations page.

- Use platforms like GuideStar or National Council of Nonprofits for news and resources.

- Consider working with CPAs who specialize in nonprofits (hi, that’s us!).

Set a calendar reminder once a year to review IRS updates and check in with your CPA about anything new that affects your organization.

Frequently Asked Questions

What is nonprofit tax compliance?

It’s the process of following all federal and state tax laws applicable to your nonprofit, including filings, registrations, and proper use of funds.

What happens if I don’t file Form 990?

You could face penalties—and after three missed years, the IRS will revoke your tax-exempt status. You’ll have to reapply from scratch.

What if my nonprofit earns income from events or merchandise?

It may trigger UBIT. If it’s unrelated to your mission, you may owe taxes and need to file Form 990-T.

Does state tax exemption happen automatically?

Nope. Even if you’re exempt federally, you still need to apply for exemption at the state level for things like sales and property tax.

How do I know which Form 990 to file?

It depends on your revenue and assets. For example, if your gross receipts are under $50,000, you’ll file the 990-N e-postcard. Need help? Our 990 prep service has you covered.

Final Thoughts: Stay Compliant, Stay Focused

Nonprofit tax compliance may sound intimidating, but once you understand the basics and stay organized, it’s completely manageable. By staying on top of your filings, UBIT risks, and state requirements, your nonprofit can stay in the IRS’s good graces—and keep your focus where it belongs: on your mission.

If you need a hand along the way, we’re here for you:

Make a one-page compliance checklist: Which 990 do we file? When is it due? Which state registrations apply? Share it with your board so everyone knows the game plan.

You’ve got the heart. We’ve got the spreadsheets. Let’s keep your nonprofit thriving and compliant! 💼🐾