Running a nonprofit organization comes with plenty of responsibilities—especially when it comes to finances. Staying compliant isn’t just about checking boxes for the IRS. It’s about building trust with donors, keeping your mission secure, and protecting your organization’s reputation. In this nonprofit financial compliance guide, I’ll walk you through the best practices to stay on track (and out of trouble). Let’s break it down!

- Understand why compliance is more than “just paperwork.”

- See how controls, records, and reports fit together.

- Get practical ideas to strengthen financial oversight.

Healthy financial compliance protects your tax-exempt status and your mission—and makes you easier to trust.

Why Nonprofit Financial Compliance Matters

Nonprofit financial compliance isn’t just about following rules—it’s about protecting your organization and the community it serves. Falling out of compliance can lead to fines, revoked tax-exempt status, or worse. But being compliant also builds trust with donors, foundations, and the public. It shows you’re responsible and worthy of their support.

It protects your nonprofit’s reputation, funding, and future impact—one policy and report at a time.

Internal Controls: Guarding Against Fraud and Mistakes

Internal controls help prevent fraud, ensure accuracy, and make your financial processes audit-ready. Here are the most important controls every nonprofit should implement:

- Segregation of Duties: Don’t let one person handle all financial tasks—split up responsibilities.

- Authorization Protocols: Require proper sign-off for purchases and payments.

- Regular Reconciliations: Reconcile bank accounts regularly (monthly at a minimum).

- Access Restrictions: Limit access to financial systems and sensitive data.

If this sounds overwhelming, a fractional CFO can help implement and monitor your internal controls.

| Control | What it protects |

|---|---|

| Segregation of duties | Prevents one person from controlling the whole cash cycle. |

| Authorizations | Stops unauthorized purchases or payments. |

| Reconciliations | Catches errors and missing transactions. |

| Access restrictions | Limits who can edit or move money. |

Accurate Record-Keeping

You can’t stay compliant if you don’t have clear, accurate records. Keeping track of every donation, expense, and grant is crucial.

What to Track

- Income: Log every donation and grant—note whether it’s restricted or unrestricted.

- Expenses: Categorize all spending by program, admin, or fundraising.

- Grant Use: Document how restricted grants are used to avoid compliance issues.

- Donation Receipts: Save documentation and issue receipts to donors for tax purposes.

Need help? Bookkeeping for nonprofits makes this part less of a headache.

If you can’t document it, you can’t prove it—to your board, donors, or the IRS.

Budgeting and Financial Planning

Financial planning is your blueprint for stability. A smart, mission-driven budget supports compliance by helping you avoid overspending and allocate funds appropriately.

- Mission Alignment: Budget with your goals in mind.

- Team Input: Include program managers and board members in the planning process.

- Contingency Funds: Always plan for the unexpected.

- Review Often: Revisit your budget quarterly and adjust if needed.

Check out our nonprofit budgeting tips for more help.

A realistic budget helps you honor donor restrictions, avoid cash crunches, and back up the numbers you report on Form 990.

Transparent Financial Reporting

Transparency isn’t just good ethics—it’s a compliance must. Annual financial statements and proper documentation show donors and the IRS that your nonprofit is operating responsibly.

Best Practices for Reporting

- Clear Financial Statements: Regularly produce and share your balance sheet and income statement.

- Annual Report: Summarize revenue, expenses, and program outcomes for stakeholders.

- Statement of Functional Expenses: Required by FASB—show how much you spend on programs vs. admin/fundraising.

- Board Updates: Keep your board in the loop with financial updates.

Want peace of mind? Schedule a financial statement review.

Donors give more confidently when they can clearly see how funds are used and what impact they’re creating.

Keeping Up with Regulatory Changes

Compliance isn’t static—laws and regulations evolve. Stay informed so your nonprofit doesn’t fall behind.

- Follow IRS Guidelines: Bookmark the IRS Nonprofit page and review it regularly.

- Know State Requirements: Rules vary widely by state for fundraising and financial reporting.

- Join Nonprofit Associations: Groups like National Council of Nonprofits offer updates and training.

- Hire Experts: Work with CPAs who specialize in nonprofits—they’ll keep you on track.

Assign someone (staff or board) to be the “compliance champion” who checks for updates at least once a year.

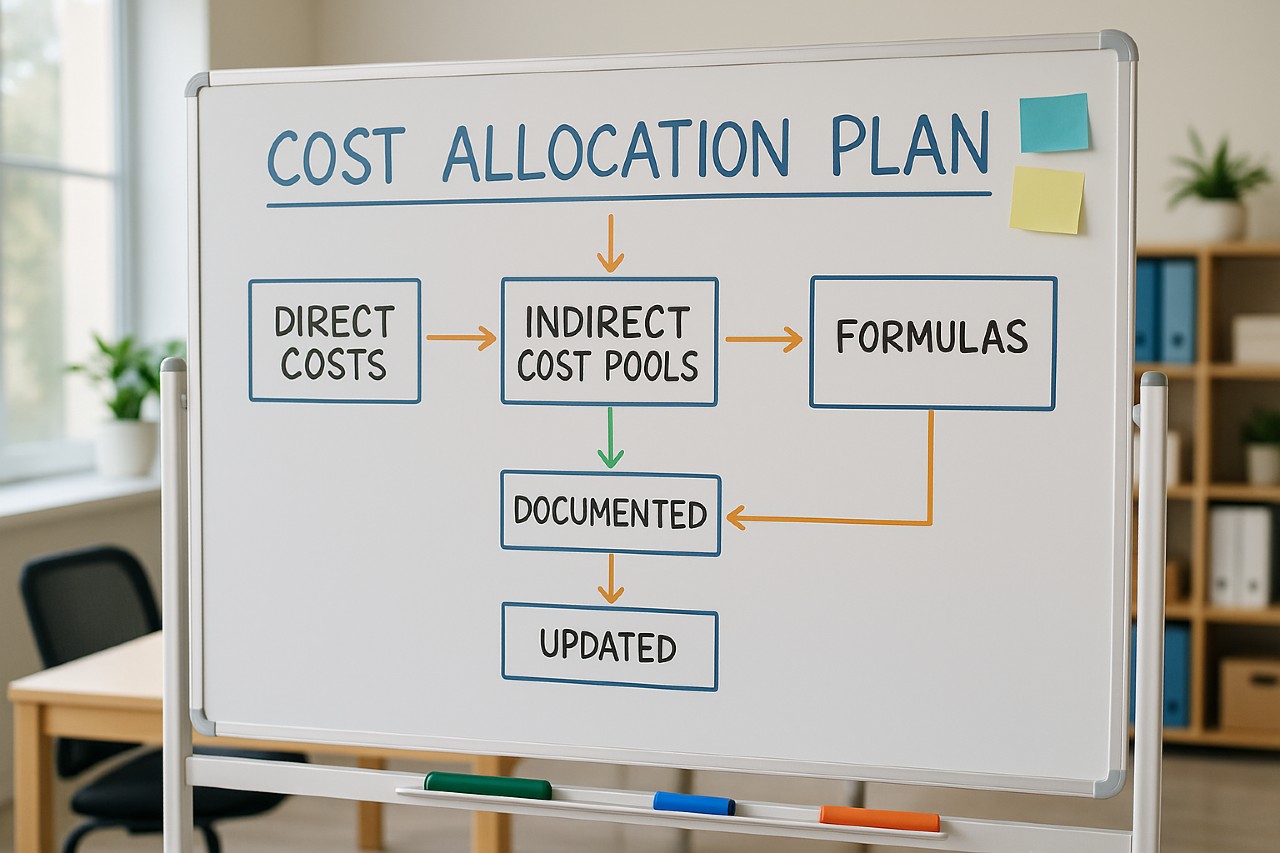

Understanding Functional Expenses

Nonprofits are required to report expenses by function. This means showing how your money is spent on:

- Program Services: The heart of your mission—feeding, rescuing, educating, etc.

- Management & General: Admin costs like insurance and salaries.

- Fundraising: Event planning, donor communications, etc.

Accurate functional reporting helps you stay compliant and transparent—and it tells your donors you’re using their money wisely.

| Category | Examples |

|---|---|

| Program services | Animal care, food, outreach, education |

| Management & general | Rent, insurance, admin salaries |

| Fundraising | Events, donor mailings, online campaigns |

Fund Accounting for Nonprofits

Unlike businesses, nonprofits use fund accounting to track how money is spent based on donor restrictions. It’s essential for managing compliance, especially with grants and restricted donations.

Benefits of Fund Accounting

- Accountability: Tracks restricted and unrestricted funds separately.

- Transparency: Shows how donor funds are used.

- Ease of Reporting: Supports clean financial statements and audits.

Many small nonprofits rely on outsourced CFOs to help manage this system effectively.

It’s how you prove—to yourself and your supporters—that restricted dollars truly went where they were promised.

Frequently Asked Questions

What is nonprofit financial compliance?

It’s the process of following all financial, tax, and reporting rules required by local, state, and federal laws. It includes filing the correct forms, accurate record-keeping, and maintaining internal controls.

What happens if a nonprofit is noncompliant?

You could face fines, lose your tax-exempt status, or damage your reputation with donors. In serious cases, there may be legal consequences.

Do all nonprofits need to file Form 990?

Yes! All federally tax-exempt nonprofits must file some version of Form 990 annually. Which version you file depends on your revenue level.

How often should nonprofits review finances?

At least monthly. Review your budget, reconcile bank accounts, and prepare financial statements regularly. Your board should get quarterly or monthly updates.

Can we outsource financial compliance?

Absolutely. Many nonprofits use outside help for bookkeeping, financial reviews, and tax filing. It’s a smart move, especially for smaller teams.

Final Thoughts: Staying Compliant and Confident

Nonprofit financial compliance is about more than just rules—it’s about building the foundation for a healthy, transparent, and thriving organization. By putting strong internal controls in place, keeping clean records, following IRS rules, and preparing accurate reports, you’re showing donors and regulators that your mission is in good hands.

If you ever feel overwhelmed, know that you don’t have to go it alone. Here are some services that can help:

- 990 Tax Filing Services

- Financial Statement Review

- Nonprofit Bookkeeping Services

- Fractional CFO Services

Create a simple compliance dashboard: internal controls checklist, key filing deadlines, and a monthly “are we on track?” review. Share it with your board so everyone owns compliance—not just finance.

You’ve got the mission—now let’s make sure the financial side supports it. 💼🐾