Understanding nonprofit treasurer duties is key to maintaining your organization’s financial health and

transparency. For many new board members, stepping into this role can feel overwhelming. But with the right

knowledge and tools, you can confidently oversee budgets, reports, and compliance without losing sleep—or receipts!

This guide breaks down the core responsibilities, common challenges, and best practices for anyone serving as a

nonprofit treasurer. Whether you’re new to the board or want to brush up your skills, this is your go-to resource.

- Just became treasurer and feel “slightly terrified.”

- Want clearer board financials (and fewer spreadsheets at midnight).

- Need practical, plain-English expectations of the role.

You’re not the bookkeeper; you’re the financial navigator helping keep the mission on course.

The Role of a Nonprofit Treasurer

The treasurer is the financial quarterback of the board. This role involves oversight—not doing all the math

yourself, but making sure the organization’s financial systems are solid and trustworthy. You help your nonprofit

stay mission-focused and financially compliant.

From reviewing reports to advising the board on fiscal decisions, the treasurer’s role ensures everyone is working

with up-to-date, accurate financial information. This builds trust with donors, foundations, and regulators.

When this role is strong, your board makes faster, better decisions—and funders notice.

Key Responsibilities of a Treasurer

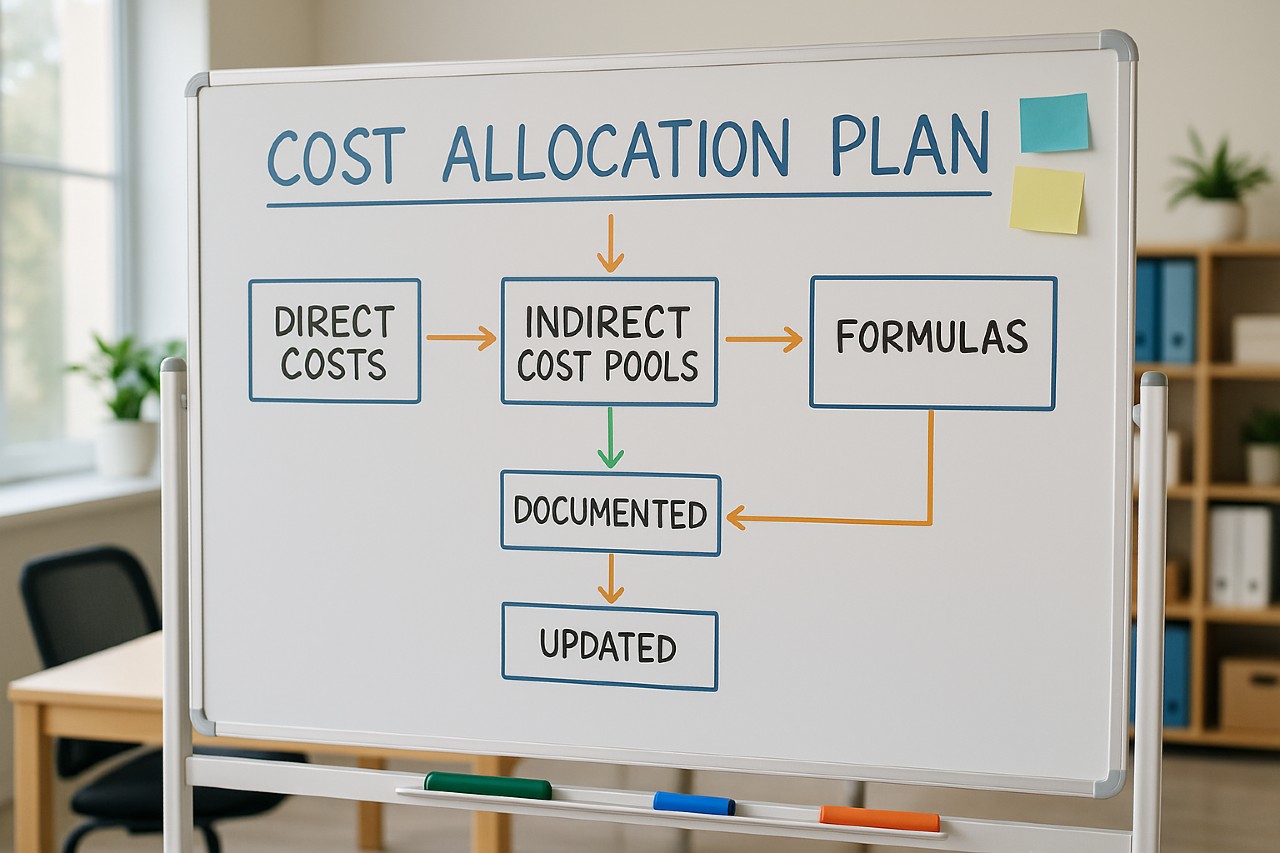

1. Financial Oversight and Reporting

- Review and present financial statements to the board (balance sheets, income, and cash flow)

- Ensure financial records follow GAAP and IRS guidelines

-

Work with staff or a

fractional CFO

to support reporting accuracy

2. Budgeting and Planning

- Collaborate with staff and board to create the annual budget

- Monitor performance against the budget throughout the year

- Help align resources with the organization’s goals

3. Internal Controls and Risk Management

- Implement policies for expense approvals, cash handling, and donor funds

- Ensure appropriate segregation of duties to reduce fraud risk

-

Support

financial reviews

or audits when needed

4. Collaboration with Board and Committees

- Coordinate closely with the finance committee

- Support board understanding of financial documents

- Help the board make informed decisions with timely reports

| Area | What you’re ensuring |

|---|---|

| Reporting | Financials are accurate, timely, and board-ready. |

| Budgeting | Spending follows the plan and supports the mission. |

| Controls | Money is protected and policies are followed. |

| Board support | Leaders understand the numbers behind decisions. |

What the Job Looks Like on Paper

Here’s a sample treasurer job description:

- Keep Accurate Records: Maintain detailed logs of all financial transactions

- Manage Cash Flow: Ensure funds are available for operations while protecting reserves

-

Work with Auditors: Assist during

nonprofit audits

and external reviews - Report to the Board: Present clear, concise financial updates with supporting statements

Whether you use QuickBooks, Aplos, or spreadsheets, maintaining accurate and transparent records is essential for

IRS compliance and donor confidence.

Best Practices for New Treasurers

Start Strong

Review recent financials, meet with the executive director, and familiarize yourself with the current budgeting

tools and processes. Understand how your nonprofit tracks restricted funds, grants, and donations.

Keep Learning

Nonprofit accounting isn’t always intuitive. Check out training resources from

AICPA

or attend webinars through

National Council of Nonprofits.

Use Technology

Automate where possible. Use cloud-based accounting software and tools like Trello or Asana to manage tasks and

timelines. Good systems make great treasurers.

Build Relationships

Maintain open communication with board members and staff. Encourage questions, offer clear reports, and

advocate for transparency and financial clarity.

Schedule a recurring “money date” each month to review reports, questions, and upcoming deadlines—before the

board meeting rush hits.

Common Challenges and How to Overcome Them

Balancing Time

Delegate where you can and use templates to streamline reporting. Set recurring dates to review financials—consistency is key.

Understanding Complex Rules

From

Form 990 filing

to restricted fund reporting, the rules can be complex. Get advice from a nonprofit CPA or enroll in compliance workshops.

Managing Conflicts of Interest

Establish conflict-of-interest policies for the board. Require annual disclosures and recuse anyone from

financial decisions where there’s a potential conflict.

Maintaining Transparency

Transparency is your best defense. Present monthly updates, call out risks early, and be honest about financial health.

Trust is built on open books.

Frequently Asked Questions

What is the role of a treasurer in a nonprofit?

The treasurer oversees financial health, budgeting, record-keeping, and reporting. They work with the board to

ensure fiscal transparency and legal compliance.

Do treasurers sign checks?

In many cases, yes—but strong internal controls should require dual signatures or board approval for larger transactions.

How do nonprofit treasurers stay compliant?

By maintaining accurate records, filing on time (especially Form 990), implementing internal controls, and

following generally accepted accounting principles (GAAP).

Can a treasurer delegate tasks?

Absolutely. Treasurers can work with staff, a bookkeeper, or a

fractional CFO

to manage day-to-day financials.

What reports should the treasurer present to the board?

At minimum: income statement, balance sheet, and cash flow. Also include notes on variances from budget and any

financial red flags.

Final Thoughts

Being a treasurer isn’t just about balance sheets—it’s about building a strong financial foundation so your nonprofit can

fulfill its mission. Whether you’re helping rescued animals, feeding families, or uplifting youth, your leadership keeps the

work going.

If you’re new to the role or just want a little backup, we’re here to help:

- Bookkeeping for Nonprofits

- 990 Tax Filing Help

- Fractional CFO Services

- Financial Statement Review

- Nonprofit Audit Support

Create a simple one-page “treasurer dashboard” with key balances, cash runway, and budget vs. actual highlights.

Bring it to your next board meeting—you’ll feel more confident, and your board will be more informed.

You’ve got this—and we’re cheering you on. 💼🐾