Budgeting for nonprofit organization is more than tracking income and expenses—it’s about being financially

sustainable while fulfilling your mission. Unlike for-profit businesses, nonprofits must juggle donor

restrictions, fluctuating funding sources, and the need to prove impact with every dollar.

Whether you’re running a cat rescue, farm sanctuary, or youth outreach group, a strong budget helps you make

smarter decisions, allocate resources effectively, and plan for long-term success. In this guide, we’ll break

down the budgeting process step by step, with practical examples and tips to help your nonprofit stay on track

(and thrive).

- Turn your budget into a mission-aligned roadmap.

- Balance unpredictable revenue with real-world costs.

- Use program, fundraising, and admin budgets with confidence.

A good budget doesn’t just say what you’ll spend—it proves how every dollar moves your mission forward.

Budgeting for a Nonprofit: The Basics

A nonprofit budget is more than just a spreadsheet—it’s your financial game plan. It outlines expected income and

expenses so leadership can allocate resources wisely and keep the mission moving forward.

Unlike businesses with predictable revenue, nonprofits rely on grants, donations, and often inconsistent funding

streams. That’s why budgeting for nonprofit organization requires planning for the unexpected and aligning every

dollar with your mission.

It’s the story of how you’ll turn donor support into real-world impact—before the year even starts.

How to Budget for a Nonprofit: Step-by-Step Guide

Step 1: Financial Situational Analysis

Start by reviewing past financials—look at donation trends, grants, and spending habits. Are there seasonal

dips in revenue? Surprises in expenses? Also check your assets, liabilities, and cash reserves.

Step 2: Define Financial Goals

Goals give your budget purpose. Whether you’re planning to expand a program, build a reserve fund, or buy a new

van for shelter transport, make sure every financial goal ties back to your mission.

Step 3: Forecasting Revenue

Revenue sources often include:

- Grants – Multi-year vs. annual, restricted vs. general use

- Individual donations – One-time gifts vs. recurring giving programs

- Fundraisers – Galas, crowdfunding, online campaigns

- Corporate sponsors or earned income – Partnerships, workshops, or product sales

Step 4: Estimating Expenses

Common categories include:

- Program costs – Direct service delivery, staff, supplies

- Salaries and benefits – Staff compensation is key to retention and impact

- Overhead – Rent, software, insurance, compliance fees

- Fundraising costs – Event planning, marketing, donor outreach

Step 5: Contingency Planning

Unexpected costs happen. Budgeting for nonprofit organization means being prepared. Set aside at least 3–6

months of expenses as an emergency fund if possible.

Need help building a long-term budget? Our

Fractional CFO services

provide expert-level planning without hiring a full-time exec.

| Step | Focus |

|---|---|

| 1. Situational analysis | Where have we been? (history, trends, reserves) |

| 2. Goals | Where are we going? (mission-aligned priorities) |

| 3. Revenue | What’s coming in? (grants, donors, events) |

| 4. Expenses | What will it take? (programs, people, overhead) |

| 5. Contingency | How do we stay steady when life happens? |

Different Budgets for Different Purposes

Program Budgets

Each program should have its own budget. Include:

- Staff time

- Materials/supplies

- Travel and contractor costs

Fundraising Budgets

Break down every event or campaign with a detailed budget. Track ROI so you know what’s working (and what’s

just draining resources).

Need to track fundraising expenses properly for your Form 990? Our

nonprofit tax filing experts

can help!

Administrative Budgets

Don’t overlook costs like:

- Rent and utilities

- Office equipment

- Software licenses

- Insurance

To stay on top of administrative spending, consider scheduling a

financial statement review

each year.

Programs (impact), fundraising (fuel), and admin (infrastructure). Cutting admin too far usually hurts the

mission—not the “overhead ratio.”

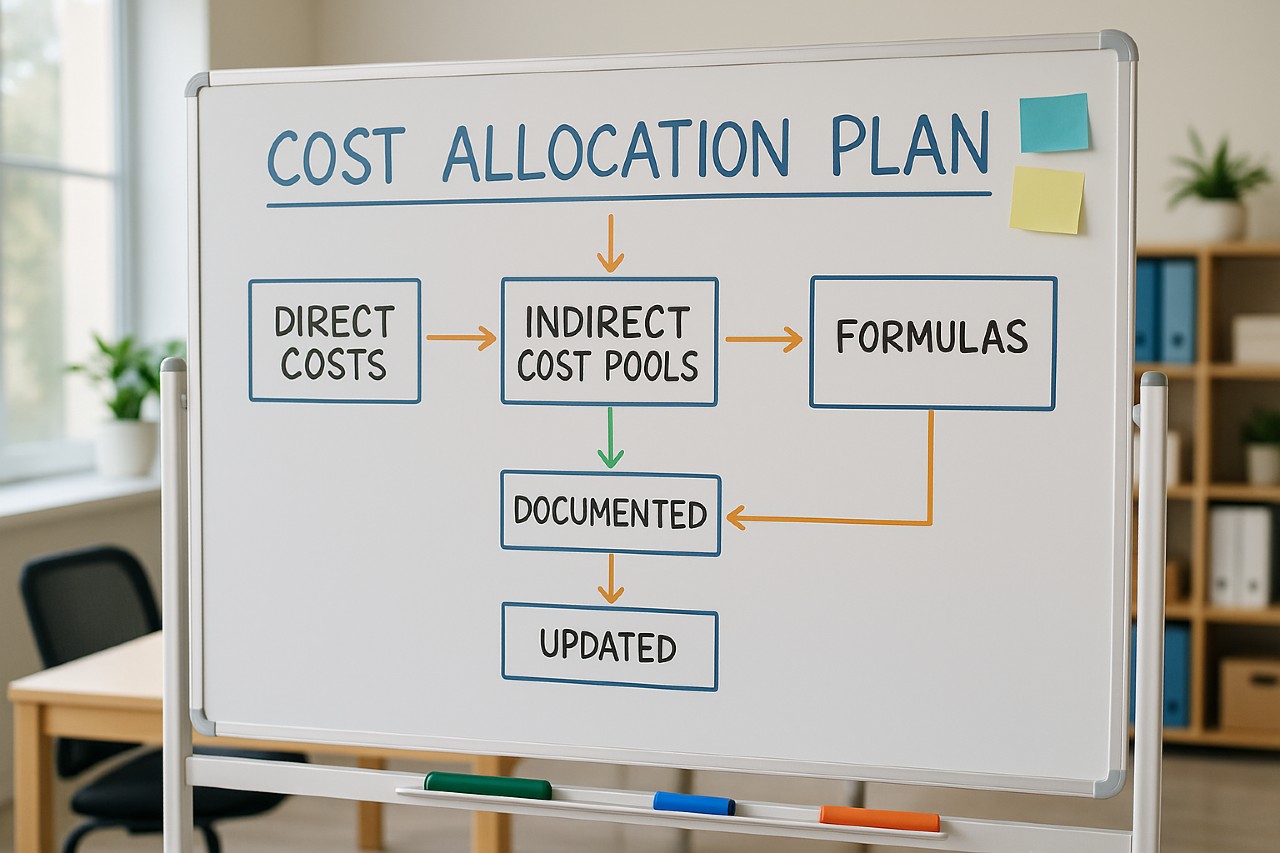

Practical Examples & Calculation Methods

Program Budget Example

- Total cost: $10,000 for staff, supplies, and travel

- Participants: 100 rescued animals

- Cost per animal served: $100

Formula: $10,000 ÷ 100 animals = $100 per animal

Fundraiser Budget Example

- Income: $17,000

- Expenses: $7,000

- Net Revenue: $10,000

Formula: $17,000 – $7,000 = $10,000 net to fund your mission.

Commonly Overlooked Costs

- Bank and processing fees

- Volunteer-related expenses

- Technology upgrades

- Contingency reserves

Want bookkeeping that catches these hidden costs? Learn more about our

bookkeeping services for nonprofits.

| Scenario | Key metric | Result |

|---|---|---|

| Program costs | Cost per participant | $100 per animal served |

| Fundraiser | Net revenue | $10,000 to support programs |

Frequently Asked Questions

Why is budgeting important for nonprofit organizations?

A budget aligns your spending with your mission, helps you prepare for uncertainty, and improves transparency

with donors and boards.

How often should a nonprofit update its budget?

Annually is the minimum. Ideally, you should review and revise quarterly to stay responsive to real-world conditions.

What’s the best budgeting software for small nonprofits?

Try tools like QuickBooks for Nonprofits, Aplos, or Wave. Look for software that supports fund accounting and

integrates with donor management systems.

How should nonprofits handle restricted funds?

Track restricted income and expenses in separate accounts. This ensures compliance with donor intent and

prevents legal issues. For more on this, visit the

IRS nonprofit resource center.

Final Thoughts

Budgeting for nonprofit organization is about more than spreadsheets—it’s about aligning your finances with your

mission. By breaking down your budget into clear categories (programs, fundraising, administration), monitoring

regularly, and planning for surprises, your organization can stay financially healthy and focused on impact.

If you need help building a stronger budget or reviewing your finances, we’re here for you:

Draft a simple 12-month budget with three columns: programs, fundraising, and admin.

Even a rough first draft will give your board clarity—and give you a stronger story for donors.

You’ve got the heart—now let’s build the budget to back it up. 🐾💰