Preparing for a nonprofit audit might sound like a stressful experience, but with the right approach, it can actually become an opportunity to boost your nonprofit’s credibility and financial health. Whether you’re running a small animal rescue or a growing sanctuary, this guide will walk you through key steps and a practical checklist to help you nail your next audit. Let’s turn your audit from panic mode into a power move!

- Understand why audits matter (beyond compliance).

- Use a ready-to-go documentation checklist.

- Spot and fix common audit issues before they blow up.

Your audit isn’t a pop quiz you’re doomed to fail—it’s a chance to prove how well you steward donor dollars.

The Purpose of a Nonprofit Audit

A nonprofit audit is more than a compliance requirement—it’s a credibility booster. It shows funders, donors, and regulators that your organization manages funds responsibly and transparently. Audits help uncover issues like weak internal controls or reporting errors that, if left unchecked, could snowball into bigger problems.

Key Benefits of a Nonprofit Audit

- Enhance credibility: Show donors and board members you’re financially sound.

- Identify risks early: Fix compliance or financial issues before they grow.

- Meet legal and funding requirements: Many states and grantors require audits for nonprofits over a certain size.

Our Financial Statement Review service can help get you audit-ready.

Pre-Audit Planning

1. Choose the Right Auditor

Find a CPA or firm experienced with nonprofit audits. Ask for references from other organizations and look for someone who communicates clearly and understands nonprofit financials.

2. Schedule Early

Audit season gets busy. Schedule your audit well in advance so your team has time to prepare and respond to auditor requests.

3. Assign Roles

Designate a point person on your team to coordinate with the auditors. Assign team members to prep documentation like payroll, bank statements, and donor records.

One clear timeline, one audit contact, and one organized document list will solve 80% of your audit stress.

Nonprofit Audit Documentation Checklist

Here’s what auditors typically want to see:

- Financial Statements

- Statement of Financial Position

- Statement of Activities

- Statement of Cash Flows

- Statement of Functional Expenses

- Bank Reconciliations

- Grant Agreements & Contracts

- Payroll Records & Tax Filings (941s)

- Receipts for Major Expenses

- Donor Acknowledgments & Contributions

- Internal Policies & Financial Procedures

- IRS Form 990 & State Filings

| Category | Examples |

|---|---|

| Core financials | Financial statements, bank reconciliations |

| Grants & donations | Grant agreements, donor acknowledgments |

| Payroll & taxes | Payroll records, 941s, benefits support |

| Policies & compliance | Internal controls, Form 990, state filings |

Want help organizing all this? Our nonprofit bookkeeping services make your records audit-ready year-round.

Conducting an Internal Review

Before your auditor shows up, conduct your own mini-audit:

- Check for errors: Review financials for inconsistencies or missing data.

- Test internal controls: Review processes like dual check signing or expense approval.

- Verify restricted funds: Ensure grants and restricted donations were used correctly.

- Train your team: Make sure staff know their role and how to respond to auditor questions.

A fractional CFO can support your internal prep and even sit in on the audit if needed.

Communicating with Your Auditor

Open communication is the key to a smooth nonprofit audit:

- Be transparent: Don’t hide problems—auditors appreciate honesty.

- Respond quickly: Delays can slow down your audit and increase costs.

- Ask questions: If something doesn’t make sense, speak up.

- Do an exit interview: Review findings and get suggestions for improvement.

Treat your auditors like partners, not opponents. The clearer your communication, the more useful their feedback will be.

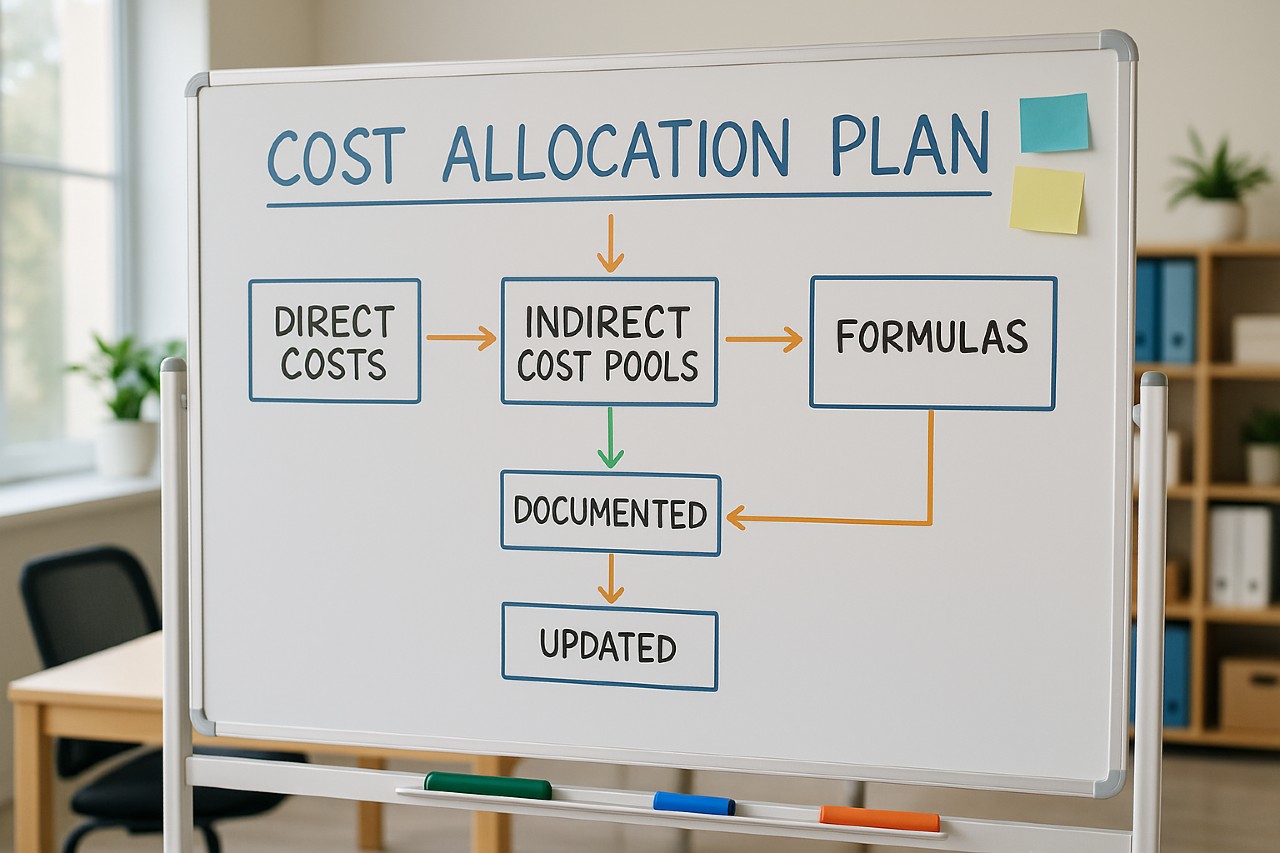

Common Audit Issues and How to Avoid Them

- Missing documentation: Use a checklist to keep things organized.

- Weak internal controls: Review approval processes and access permissions.

- Grant mismanagement: Keep separate tracking for restricted funds.

- Late reporting: Build audit prep into your annual calendar.

Bonus tip: Many states require annual audits based on your funding levels. Visit your state’s charity regulator for thresholds and rules.

| Issue | Prevent it by |

|---|---|

| Missing documentation | Using a year-round audit checklist and shared folder. |

| Weak controls | Requiring dual approvals and separating duties. |

| Grant mismanagement | Tracking restricted funds by grant and purpose. |

| Late reporting | Putting audit prep on your annual board calendar. |

Post-Audit: What Comes Next

After You Receive the Audit Report:

- Review findings: Go over them with your team and board.

- Act on recommendations: Implement changes where needed.

- Share with stakeholders: Use your clean audit as a fundraising tool!

Turn key audit recommendations into a simple action plan with owners and deadlines—then celebrate progress at your next board meeting.

Frequently Asked Questions

What is a nonprofit audit?

A nonprofit audit is an independent examination of your financial records, internal controls, and compliance practices. It helps verify the accuracy of your financials and build credibility with funders and regulators.

Is an audit required for all nonprofits?

No—but many states and grantors require audits for nonprofits with income over a certain threshold. Check with your state’s charity bureau or IRS nonprofit guidelines.

How much does a nonprofit audit cost?

Costs typically range from $5,000 to $20,000 depending on your org’s size and complexity. Small nonprofits may qualify for lower-cost reviews instead of full audits.

How long does a nonprofit audit take?

Expect the process to take 3–8 weeks from start to finish. That includes planning, fieldwork, follow-ups, and final report issuance.

How can I make audit prep easier?

Stay organized year-round with monthly reconciliations and regular Form 990 filings. This makes audit season a whole lot less stressful.

Final Thoughts: Audit-Ready and Empowered

Don’t let the word “audit” scare you. A nonprofit audit is your chance to level up your financial practices, impress your funders, and prove that your mission is in solid hands. Preparation is everything—from gathering documents and strengthening controls to choosing the right auditor and asking questions.

Need help getting started? We’re here to make your audit process smooth, stress-free, and maybe even kind of satisfying:

- Financial Statement Review

- Tax Filing for Nonprofits (Form 990)

- Bookkeeping for Nonprofit Organizations

- Nonprofit Audit Support

Create a shared “audit folder” (digital or physical) and start dropping in bank recs, grant agreements, and major invoices each month. By the time audit season arrives, half the work will already be done.

You’ve got the mission—we’ll help you keep it audit-proof. 🐾💼